Sri Lanka Raises Rates To Curb Consumer Spending

Fahad Shabbir (@FahadShabbir) Published July 28, 2016 | 10:26 PM

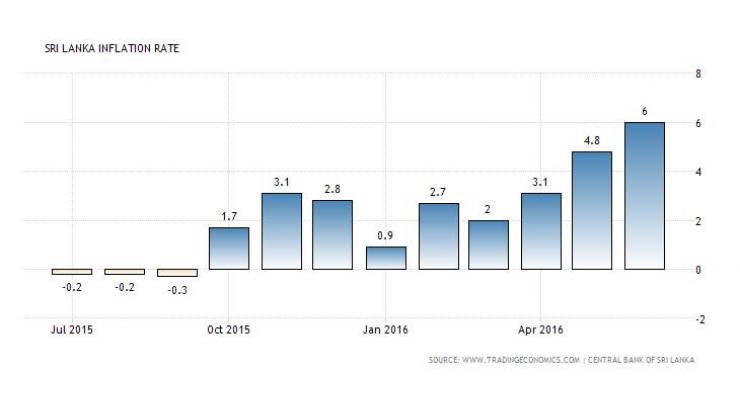

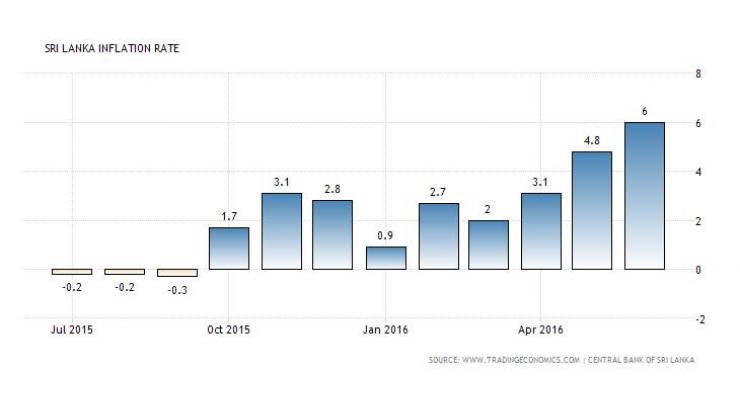

COLOMBO, (APP - UrduPoint / Pakistan Point News - 28th july, 2016) - Sri Lanka raised its key interest rate by 50 basis points Thursday, saying it was necessary to discourage excessive consumer spending and head off a balance of payments crisis. The Central Bank of Sri Lanka raised its benchmark lending rate from 8.0 percent to 8.5 percent, the second such increase in five months. The latest move comes nearly two months after Sri Lanka secured a $1.5 billion bailout from the International Monetary Fund to address the country's widening trade deficit and shore up foreign reserves. "The continued appetite for bank credit by the private sector in spite of the upward movement in market interest rates could create excessive demand and high inflation in the economy in the future," the bank warned in its monthly review. Sri Lanka faced an impending balance of payments crisis last year as the government, elected in January 2015, sought to implement election pledges of higher public sector salaries and lower fuel and utility prices and encourage imports.

It began drawing down the first instalment from the $1.5 billion IMF bailout in June. The Indian Ocean island of 21 million enjoyed blistering economic growth rates averaging more than 8.0 percent for two years after a prolonged civil war ended in 2009. But the pace of expansion has since slowed, falling to 4.8 percent in 2015, down from 4.9 in the previous year, according to official data.

In 2009, Sri Lanka received $2.6 billion from the IMF to boost its financial reserves, which dropped below $1 billion at the height of fighting between Tamil Tiger rebels and troops.

Related Topics

Recent Stories

50MP is Better than 200MP?

Mohammad Amir’s participation in T20I series against Ireland, England hangs in ..

Police arrest some lawyers after clash outside LHC

US wants basic human rights for Imran Khan, all other prisoners

Hajj season begins: Karachi Airport Set for Inaugural Flight

IHC orders Jail officials to shift Bushra Bibi to Adiala Jail from Bani Gala

Projects of worth $25b being implemented in Pakistan under CPEC framework: Ahsan

Saudi investors evince special interest in diverse fields

Currency Rate In Pakistan - Dollar, Euro, Pound, Riyal Rates On 8 May 2024

Today Gold Rate in Pakistan 08 May 2024

Delegation of international investors meets Finance Minister

Federal Govt stands with Balochistan for its development: Naqvi

More Stories From World

-

N. Macedonia polls set to upend ties with EU neighbours

6 minutes ago -

Israel pounds Gaza as truce talks resume

26 minutes ago -

Russia says it captured two more villages in Ukraine

1 hour ago -

Russia 'cannot' investigate AFP journalist's 2023 killing in Ukraine: Kremlin

1 hour ago -

Indonesia April temperatures hottest in four decades: weather agency

1 hour ago -

Bangladesh recall Shakib for last two Zimbabwe T20s

2 hours ago

-

11 Hajj flights carrying 2,160 Pakistani pilgrims to land in Madinah on Thursday

2 hours ago -

Leading Pakistani media group publishes 60th episode of BRI column

2 hours ago -

Fighter jet crashes at Singapore airbase

2 hours ago -

April temperatures in Indonesia hottest for more than four decades

2 hours ago -

Dozens of cholera cases reported in flood-hit Kenya

2 hours ago -

Bangladesh recall Shakib for last two Zimbabwe T20s

2 hours ago