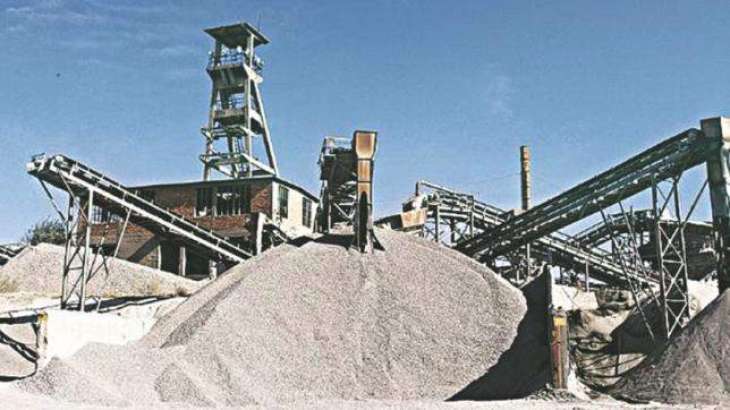

The country's total cement sales during the concluding fiscal year of 2018-19 is expected to remain flat, closing in at around 46 million after a long time of 7 years, mainly due to slower economic growth

Lahore (Pakistan Point News / Online - 09th July, 2019) The country's total cement sales during the concluding fiscal year of 2018-19 is expected to remain flat, closing in at around 46 million after a long time of 7 years, mainly due to slower economic growth.According to cement industry experts, total domestic sale of FY19 is expected to decline after seven years; down by 3% annually to 39.8 million tons versus 41 million tons during FY18. The Primary reason for domestic sales attrition can be attributable to decline in government spending, sluggish growth in GDP growth, and rising inflation and interest rates affecting housing sector.

The region wise data suggests that sales from the northern region are anticipated to decline by 6% YoY to 31.9 million tons owing to lower than expected demand from governments project due to a high base election year. On the contrary, cement sales in the southern region are expected to grow by 11% YoY to 7.9 million tons due to penetration of manufacturers in the south Punjab market.According to cement industry experts, effective capacity utilization during FY19 is anticipated to fall by 11ppts to 84% primarily on the back of multiple expansions by various cement companies including Maple Leaf Cement (MLCF), Cherat Cement (CHCC), Bestway cement (BWCL) and DG Khan Cement (DGKC).

They said that total export sales is likely to grow by 37% YoY to 6.5 million tons majorly contributed by southern region, with sales expected to witness a growth of 141% YoY to 4mn tons. However, sales from the northern region are anticipated to fall by 19%Y oY to 2.5mn tons, respectively.