A filer can use their CNIC number as National Tax Number (NTN) to register online.

Lahore (Pakistan Point News – 27th March, 2019) As the deadline to file Income Tax Returns is approaching, citizens are concerned about how to file them.

The Federal board of Revenue (FBR) had extended the last date of filing of Income Tax Returns and Statements for the Tax Year 2018 till 31st of this month.

All those persons who have not yet filed their tax returns, have been urged to take advantage of this opportunity as FBR will legally proceed against those persons who are liable to file returns but do not file it by this extended date.

Comparing advantages and disadvantages of being tax filer and non-filer

The name of the filer would be enlisted among the active taxpayers immediately after filing income tax returns. They will then be able to take advantage of numerous facilities offered by the government for active tax payers.

In case of failure in filing tax returns by due date, the taxpayers would have to wait for one whole year to become active taxpayer.

Similarly, tax filers would have to pay only half of withholding tax as compared to the tax being paid by non-filers.

A non-filer cannot purchase any property that is valued over Rs 5 million whereas active tax payers are not barred from purchasing any property.

Furthermore, the importers would have to pay 8% tax (Rs 160,000 on Rs two million) on import of raw material whereas the tax filers pay only 5.5% (for example Rs 110,000 on Rs two million) on import of raw material whereas non-filer exporters would have to pay nine% duty i.e (Rs 180,000 on export of goods worth Rs 2 million) on commercial exports.

However, the filers pay only 6% duty (Rs 120,000 on export of goods worth Rs two million) on their commercial exports.

Likewise, non-filers will have to pay 20% tax on their dividends (company's profit) against the 15% tax paid by active tax payers.

Moreover, non-filers pay 15% tax on profit of banks and saving scheme against the 10% tax paid by filers, whereas the tax filers pay 4.5% duty on supply of goods to government, and companies as compared to 9% tax paid by the non-filers.

On amount of contracts, the non-filers pay 15% tax against 7.5% tax paid by the filers and active tax payers pay 15% tax on prize money of prize bonds whereas non-filers pay 25% tax on the same.

Similarly taxpayers pay 12% tax on commission amount whereas non tax payers pay 15% tax on the same. On annual token of vehicles, filers pay Rs 800 to 10,000 while non-filers pay Rs 1200 to Rs 30,000 tax, whereas on registration of vehicles, tax filers pay Rs 15000 to Rs 250,000 as withholding tax while non-filers pay Rs 25000 to Rs 400,000.

On cash withdrawal of over Rs 50,000, tax filers pay 0.3% tax against 0.6% tax paid by the non-filers, whereas filers pay nothing on bank transactions (cross cheque, pay order, and demand draft) while non-filers pay Rs 600 as tax on each bank transaction.

Furthermore, on property transfer active tax payer pay only 1% tax against 2% tax paid by non-filers, and tax filer pay 2% on total amount of purchased property while non-filer pay 4% on the same.

The non-filer pay 10% tax on auctioning by government and other companies whereas non-filers pay 15% on the auction of goods of government or other companies.

Steps to file tax returns online

This is why you need to file your tax returns at the earliest so you can avail all these benefits. urdu Point is providing you the easy guidelines to file you tax returns online free of any hassle or the services of a tax lawyer or consultant.

But before going online, there are some things you need to know about filing tax returns.

It is essential for every government employee drawing annual salary of Rs 400,000 to file annual income tax returns or more and the last date is March 31. The government determines how much the tax rate applies to your earnings year by year, with the annual budget determining these rates in June of every year. You will need to calculate your tax rate according to the income slab you fall in before filing tax returns online.

Register at FBR’s E-Enrolment System

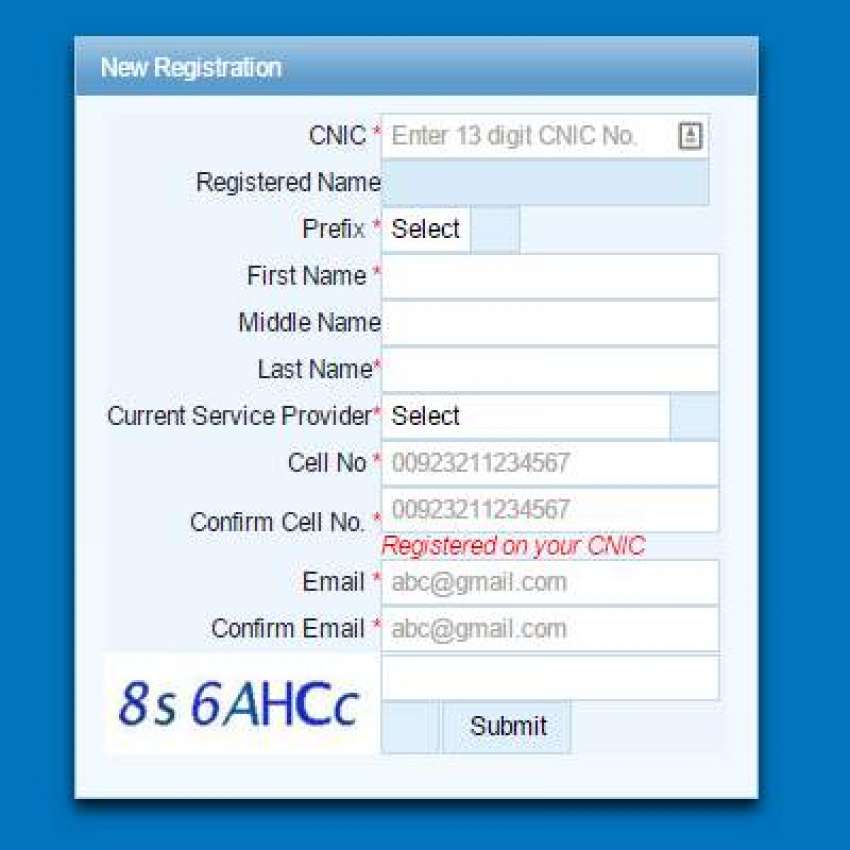

A filer can use their CNIC number as National Tax Number (NTN) to register online.

Follow the following steps:

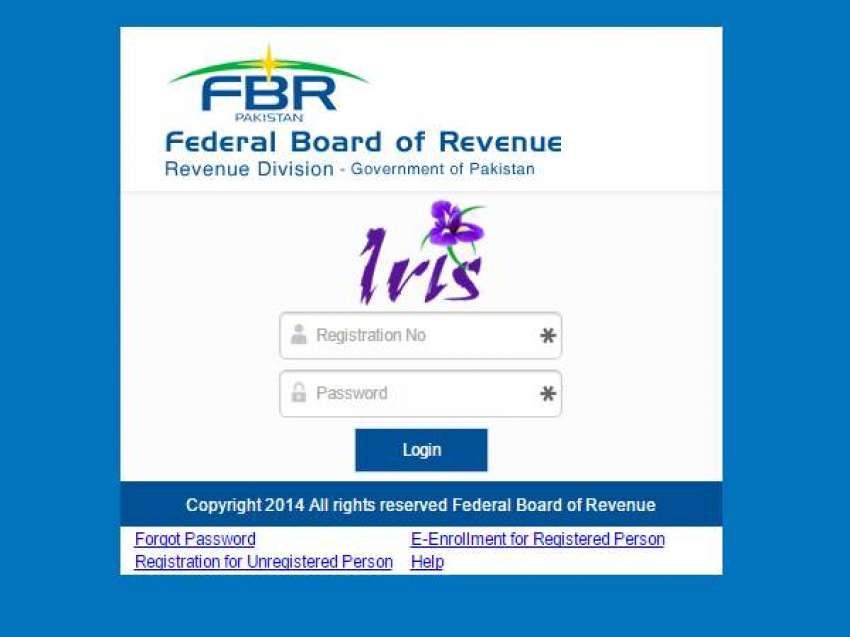

- Go to the main page of Iris, FBR’s e-Enrolment system, for tax payer registration and get your Registration Number and password.

- If you are a first time user, go to ‘Registration for Unregistered Person’. Enter the relevant information. You will receive a confirmation email or SMS to verify your account, having the PIN or password to log into your account.

- The next step after registration is to file your wealth statement by salaried persons and you are a tax filer!

Requirements for User ID at Iris

There are certain requirements to register your user ID for Iris. These are as follows:

- In case of individual Pakistani, you have to enter 13-digit CNIC/NICOP number without dashes.

- In case of individual Non-Pakistani, you have to enter 7-digit NTN without dashes.

- In case of AOPs/Companies, 7-digit NTN needs to be entered without dashes.

This is how NTN can be registered online for Companies and AOPs

Use your web browser, preferably internet Explorer, to register for National Tax Number (NTN) online of the company or AOP. Follow the following steps:

- Go to fbr.gov.pkand select E-registration tab.

- Enter your CNIC Number, name and upload an image

- Enter your date of birth (as mentioned on CNIC), residential address, activity, landline and mobile number and email address.

- Select Authorized Representative u/s 172 if you are filing your own tax returns and then select ‘Self’

- Click ‘Save Registry’

- If you are an employee, mention your employer’s NTN and city of your employment in the next column. If you are a businessman, enter the details of your business.

- You are now done with your application. Print this application and sign it.

- You will get an alert if there is an existing NTN from your previous job. In case of any doubt, use your CNIC number to get it.

- You will receive a new NTN in two working days through email.

- Attach a paid electricity bill, salary certificate and copy of CNIC with the printed application. Take the application to the concerned RTO office where you will be issued the NTN certificate.

Now that you have been educated about the importance and process of filing tax returns, do not hesitate and go online to become an active taxpayer.

Being a Pakistani, it is important for every citizen to become an active taxpayer so the tax base can be enhanced and broadened.